Tuscarawas COUNTY AUDITOR

Property Search

Search Property Information

Tax Estimator

Check Tax rates in lorain

Tax Calculator

Calculate Your Property Tax

Court Docket

Tuscarawas County docket

Jail Inmate

jail inmate Search in Ohio

The Tuscarawas County Auditor is not just a regular government office it plays a key role in maintaining financial accuracy and transparency across Tuscarawas County, Ohio. This office is responsible for managing public financial records, reviewing property values, and ensuring that tax assessments are fair and accurate for all residents.

By carefully auditing property data, tax rates, and valuation records, the Tuscarawas County Auditor helps protect public trust and keeps the local financial system running smoothly. Homeowners, business owners, and investors all rely on this office for reliable information that affects important financial decisions.

Understanding how the Tuscarawas County Auditor works can help you stay informed, avoid issues, and remain compliant with local laws. In this guide, we’ll clearly explain the responsibilities of this office and why it plays such an important role in the county’s economy.

3 Effective Ways to Do a Property Search in Tuscarawas County

There are three primary ways to perform a property search in Tuscarawas County that residents, buyers, and investors commonly rely on. These methods allow you to quickly find ownership records, property details, and tax-related information without confusion.

The Tuscarawas County property search system is designed to be reliable, accurate, and easy to use, making it a practical choice for property research, record verification, and informed real estate decisions.

Tuscarawas County Property Search by Owner Name

The Tuscarawas County property search by owner name allows users to easily find property records using an individual or business name. This method provides quick access to ownership details, parcel information, assessed values, and related tax data, making property research simple and reliable.

Tuscarawas County Property Search by Address

The Tuscarawas County property search by address helps users locate property records by entering a street address. It provides clear details such as ownership information, property value, parcel data, and tax records, making it a convenient option for accurate and efficient property research.

Tuscarawas County Property Search

The Tuscarawas County property search is a simple and reliable tool for finding detailed property information. Users can search by owner name, address, or parcel number to access ownership records, property values, land details, and tax information, making it ideal for research and verification purposes.

J. Craig Snodgrass, CPA, CGFM – Tuscarawas County Auditor

J. Craig Snodgrass, CPA, CGFM serves as the Tuscarawas County Auditor, overseeing property assessments, financial records, and tax administration across the county. Known for accuracy, transparency, and public service, his office ensures residents and businesses have reliable access to property information and official county data.

Leadership in Tuscarawas County, Ohio

Tuscarawas County’s leadership plays a vital role in managing public resources, maintaining accurate property records, and ensuring transparent financial practices. The county’s officials work to serve residents, businesses, and investors efficiently, providing reliable information and fostering trust in local government operations.

Tuscarawas County Auditor Roles and Responsibilities

The Tuscarawas County Auditor is responsible for maintaining accurate property records, assessing property values, and managing tax-related information for the county. This office ensures transparency, fairness, and accountability in property assessments, financial reporting, and public records, helping residents, businesses, and investors make informed decisions.

Property Valuation

The Tuscarawas County Auditor’s Office carefully evaluates each property to determine its accurate market value. This thorough assessment ensures that property owners and buyers have reliable information. Accurate valuations are essential for fair taxation, proper financial planning, and supporting local governance, creating a balanced and transparent property system.

Tax Assessment

Based on property valuations, the Auditor’s Office applies tax rates transparently and consistently. This ensures that every property owner pays a fair share, supporting local government functions. Accurate tax assessments provide clarity, prevent disputes, and guarantee that collected funds are properly allocated to public services, infrastructure, and community development

Equity Maintenance

The property assessment system guarantees fairness across all property owners. High-value and low-value properties are taxed proportionally, maintaining financial balance in the community. This approach promotes accountability, prevents inequalities, and ensures that residents contribute fairly to the local government, creating a just and trustworthy taxation environment.

Support Local Services

Property taxes collected by the Auditor’s Office directly fund schools, roads, emergency services, and public infrastructure. Accurate assessments ensure that resources are distributed appropriately. This critical function helps maintain and improve community services, supporting sustainable growth, safe neighborhoods, and a high quality of life for all residents.

Reliable Information

The Auditor’s Office keeps detailed and up-to-date property and tax records. Residents and businesses can access accurate information for financial planning, property transactions, and dispute resolution. Reliable records enhance transparency, foster trust in local governance, and ensure accountability, giving the community confidence in property ownership and taxation processes.

Transparency

The property assessment and taxation process is conducted openly and clearly. Policies, calculations, and records are publicly accessible, allowing residents to verify their property and tax information. Transparency promotes accountability, builds community trust, and ensures fair treatment for all property owners while reinforcing the integrity of local government operations.

Key Roles of the Tuscarawas County Auditor

The Tuscarawas County Auditor plays a crucial role in maintaining accurate property records, overseeing fair tax assessments, and managing county financial data. The office ensures transparency, supports public trust, and provides residents, businesses, and investors with reliable information for property decisions, taxation, and local financial planning.

Services Offered by the Tuscarawas County Auditor’s Office

The Tuscarawas County Auditor’s Office provides a variety of essential services to residents, property owners, and businesses. These include property record management, tax assessment and collection, property valuation, GIS mapping, and access to official ownership and parcel information. The office ensures transparency, accuracy, and easy access to trusted county data for informed decision-making.

Tuscarawas County Board of Revision

The Tuscarawas County Board of Revision reviews property assessments, hears appeals from owners, and ensures fair, accurate valuations for equitable taxation across the county.

Tuscarawas County GIS Parcel Viewer

The Tuscarawas County GIS Parcel Viewer allows users to explore property boundaries, land details, and parcel information visually, providing an easy, accurate tool for research, planning, and property verification.

Tuscarawas County Sales Report

The Tuscarawas County Sales Report provides detailed information on recent property transactions, including sale prices, dates, and ownership changes, helping residents, investors, and businesses track real estate trends accurately.

Tuscarawas County Court Docket

The Tuscarawas County Court Docket lists scheduled court cases, hearings, and legal proceedings, providing residents, attorneys, and researchers with up-to-date information on the county’s judicial activities efficiently.

Tuscarawas County Clerk of Courts

The Tuscarawas County Clerk of Courts manages court records, filings, and official documents, providing residents and legal professionals with accurate, accessible, and reliable information for all county judicial matters.

Tuscarawas County Public Records

Tuscarawas County Public Records provide residents and businesses access to official documents, including property, court, and financial records, ensuring transparency, accountability, and reliable information for research and decision-making.

Tuscarawas County Marriage and Divorce Records

Tuscarawas County provides official marriage and divorce records, offering residents accurate, verified, and accessible information for legal and personal use.

Tuscarawas County Tax Rates

Tuscarawas County sets transparent tax rates, ensuring fair property taxation and funding local services for residents, businesses, and community development projects.

Tuscarawas County Property Tax Rates

Tuscarawas County property tax rates ensure fair, transparent taxation, funding local services while providing residents and businesses accurate, reliable information for informed financial decisions.

Tuscarawas County Sales Tax Information

Tuscarawas County sales tax information provides residents and businesses clear, accurate details on tax rates, collection, and compliance for purchases and commercial transactions.

Tuscarawas County Local Tax Resources

Tuscarawas County local tax resources offer residents and businesses guidance, tools, and accurate information for managing property, sales, and other county tax obligations efficiently.

Tuscarawas County Jail Inmate Search

Tuscarawas County Jail Inmate Search allows residents to quickly access current inmate information, including booking details, charges, and custody status, ensuring transparency and public safety.

Tuscarawas County Dog License and Application

Tuscarawas County Dog License and Application

In Tuscarawas County, dog owners are required to register their pets through the Dog License and Application process. This ensures pets are properly licensed, helps maintain public safety, and promotes responsible ownership. The application provides all necessary details, including pet information, owner details, and applicable fees. Licensed dogs are easier to track if lost, and the program supports local animal control and community health initiatives. Residents can complete the process online or in person at the county office, making it simple, convenient, and compliant with Tuscarawas County regulations.

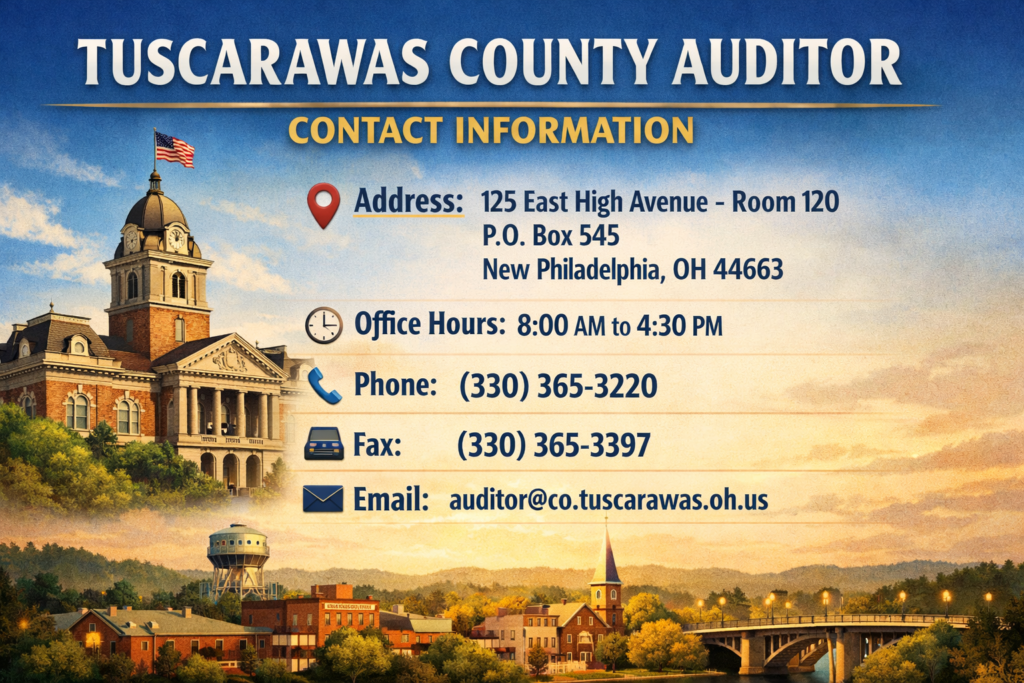

tuscarawas County Auditor Contact Information

FAQs

How can I search property records in Tuscarawas County, Ohio?

You can search property records in Tuscarawas County by owner name, property address, or parcel number using the official county property search tool for accurate results.

How is property tax calculated in Tuscarawas County?

Property tax in Tuscarawas County is calculated based on assessed property value and local tax rates, which you can estimate using the county’s tax calculator or estimator tools.

What should I do if I believe my property value assessment is incorrect?

If you believe your property assessment is incorrect, you can file an appeal with the Tuscarawas County Board of Revision for review and possible adjustment.

How can I find court case information in Tuscarawas County?

You can access court case details, hearing schedules, and legal records through the Tuscarawas County Court Docket or the Clerk of Courts online services.

How do I search for inmates in the Tuscarawas County Jail?

You can perform a jail inmate search in Tuscarawas County by using the official inmate lookup system to view booking details, charges, and custody status.